Annual Member Fees and CPD

Do you have questions about CPA Canada Fees? Visit the CPA Canada FAQ page.

The deadline to complete Spring Renewal is April 30. Completion of Spring Renewal entails the following:

- Report your CPD activities undertaken in the prior year and file your CPD declaration through the Portal as required by Bylaw 23.8;

- File your member registration renewal through the Portal as required by Bylaw 10.4; and

- Pay your annual member registration fees as required by Bylaw 130.1(a).

Member Renewal and Fees

All CPAs are required to complete an annual renewal of member registration with CPA Saskatchewan. The renewal cycle begins in April of each year. The renewal cycle includes declaring Continuing Professional Development (“CPD”) activities for the prior year, updating contact information, declaring compliance with the Rules, and paying fees.

The renewal is due April 30 to ensure your CPA designation remains in good standing with CPA Saskatchewan. If your renewal is not completed by this date, your standing with CPA Saskatchewan will be In Default and you will be notified of your non-compliance with the applicable Bylaws.

Your Portal login is your preferred email address in our records. If you have forgotten your password, click the “Forgot password” link on the login page to reset your password. If you need to change your preferred email address, please email registrar@cpask.ca and include your CPA Saskatchewan member ID for verification purposes.

To obtain an invoice of your registration fees once you have submitted your member renewal, click on “Member Renewal Fees” on the Progress Tracker and then “Confirm Fees”. Select “Generate Invoice/Pay by cheque or EFT” in the cart, then “Submit Order”. You do not need to enter anything in the PO number field. Click on "My Renewal" at the top menu, then the "Member Renewal Fees" button. Your invoice will be under "Open Invoices" in the "Invoices/Receipts" tab. This option is required if your employer will be paying your fees or if you will be paying by cheque.

Invoices are no longer available once payment is made. Once paid, the receipt will be made available under "Paid Invoices" in the "Invoices/Receipts" tab.

Continuing Professional Development

Every member shall participate in CPD (Bylaw 23.1). The minimum requirements are:

- 120 hours of CPD every 3 years and 20 hours annually (Bylaw 23.2)

- 60 hours of verifiable CPD every 3 years and 10 hours annually (Bylaw 23.3)

- 4 hours of verifiable CPD every 3 years related to ethics (Bylaw 23.4)

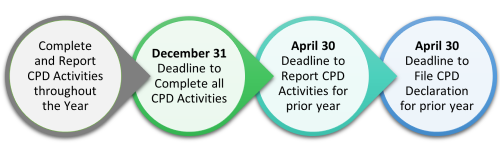

Deadline to Complete and Report

CPD activities are monitored on a calendar year basis; therefore, you have until December 31 of each year to complete the minimum CPD requirements (Rule 323.3). Ensure each CPD activity is reported in the calendar year in which it is completed.

The deadline to report your completed CPD activities and to make your annual CPD declaration is the following April 30 (Rule 323.3).

Ensure you retain documentation to support the verifiable CPD reported in a safe place for a minimum of four (4) years in case we request this information at a later date (Rule 323.17).

Be Proactive!

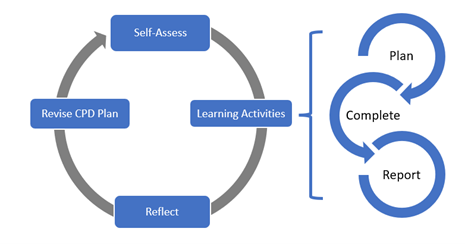

When planning out CPD activities for the calendar year, ensure there is appropriate balance in your learning activities, with careful selection of learning activities that will enhance or maintain the specific technical and enabling competencies required of your current or future role as a CPA.

We encourage you to view this process as a cyclical, proactive process:

Modified from: https://www.ifac.org/system/files/publications/files/IAESB-International-Education-Standard-7-At-a-Glance.pdf

Primary Members

For primary members, consider reporting your CPD activities through the member portal as they are completed throughout the year. This will allow you to regularly check on the status of your accumulated CPD hours to ensure you are able to proactively plan to meet the minimum CPD requirements annually.

The ability to make your annual CPD declaration is available through the member portal in April during Spring Renewal.

The CPD Hours Summary table on your My CPD page will automatically calculate the annual and three-year CPD hours remaining based on your specific circumstances:

- New members: In the first year of registration, a new primary member must comply with the annual CPD requirements of 20 total hours and 10 verifiable hours (Rule 323.4).

- Note: The first year’s CPD requirements are not pro-rated, but a new CPA is able to use learning activities completed from January 1 of the year they come to membership.

- Members exempt for one (1) calendar year in the three-year cycle: The three-year CPD requirements are reduced to 100 total hours, 50 verifiable hours, and 4 verifiable ethics hours (Rule 323.12).

- Note: While the use of the CPD reporting tool is optional during your period of exemption, any CPD hours completed and reported during an exemption year are counted towards the minimum CPD requirements of the next applicable three-year cycle.

- Members exempt for two (2) calendar years in the three-year cycle: The member is exempt from the three-year minimum CPD requirements and is only required to comply with the annual CPD requirements of 20 total hours and 10 verifiable hours (Rule 323.13).

- Note: While the use of the CPD reporting tool is optional during your period of exemption, any CPD hours completed and reported during an exemption year are counted towards the minimum CPD requirements of the next applicable three-year cycle.

- Note: If you return to practice after being exempt for more than 2 consecutive years, you are required to submit a CPD plan for approval prior to recommencing practice (Rule 323.14)

- Members on an approved CPD plan: Members on an approved CPD plan in the current calendar year must also add in the prior year CPD deficiency to the annual CPD hours remaining calculated above (Rule 323.21). This will not be accurately reflected in the hours remaining columns of the CPD Hours Summary!

- Note: If you are on an approved CPD plan, refer to your CPD plan approval email sent from monitoring@cpask.ca for a summary of the total CPD hours required for the current year or contact us at monitoring@cpask.ca.

Primary Licensed Members

Primary members who are licensed to practice professional accounting (i.e., are authorized on behalf of a firm to issue audit, review, other assurance, or compilation engagement reports) are required to comply with both the general minimum CPD requirements and the minimum CPD requirements specific to licensure.

The minimum CPD requirements specific to licensure are:

- Comprehensive – 50 hours of verifiable CPD specific to relevant assurance services every three years (Rule 316.12)

- Specified – 25 hours of verifiable CPD specific to relevant assurance services every three years (Rule 316.13)

- Compilation – 10 hours of verifiable CPD specific to compilation engagement services every three years (Rule 316.14). A minimum of 3.5 CPD hours within the 3-year period must relate to the compilation engagement standard (CSRS 4200) and/or the quality management standards (CSQM 1 and 2) specifically. Up to 6.5 CPD hours maximum overall within the 3-year period relating to taxation, management accounting or finance technical competencies may be allocated towards meeting the remaining minimum licensing requirements. CPD that relates to enhancing professional judgment, critical-thinking skills, documentation skills, leadership skills, or communication skills may be allocated. CPD relating to financial reporting standards may be allocated, provided it is relevant to the member’s practice.

The deadline to renew a member licence (which includes the requirement to report verifiable CPD activities completed in the calendar year that have been allocated to licensing) is December 1 of the year for which a licence is held (Rule 316.3).

Affiliate Members

For affiliate members, the use of the CPD reporting tool through the CPA Saskatchewan member portal is optional.

To meet the CPD requirements as an affiliate member of CPA Saskatchewan, you are required to annually declare the Provincial Institute to which CPD activities were reported and whether you complied with the minimum CPD requirements under Bylaws 23.2, 23.3, and 23.4 for that calendar year (Rule 323.6). Any affiliate member that is not in compliance with the minimum CPD requirements will have a condition noted of their registration (Rule 323.7).

The ability to make your annual CPD declaration is available through the member portal in April during Spring Renewal.

Out of Country Members

A primary member whose permanent residence is outside of Canada may request an exemption from the minimum CPD requirements provided they hold membership in an equivalent professional body with substantially similar CPD requirement (Rule 323.5). Please contact monitoring@cpask.ca for further information.

Ethics CPD Hours

Members are required to complete 4 verifiable hours of CPD related to professional ethics every three years (Bylaw 23.4). The professional ethics requirement can be fulfilled through a dedicated ethics course or through an allocation of time during a learning activity that was spent on subject matter that provides learning specific to ethical principles that are relevant to your work or professional situation. It is anticipated that the 4 hours would be accumulated through various separate professional ethics learning activities completed throughout the three-year period.

Some examples of ethics PD topics are:

- CPA Saskatchewan regulatory updates covering the CPA Saskatchewan Act, Bylaws, Board Rules and Rules of Professional Conduct

- Regulatory updates that are relevant and appropriate to your professional role or industry

- Professional conduct

- Corporate codes of conduct

- Independence/conflict of interest

- Ethical decision making, approaches, thinking and case studies

- Ethical business culture

- Corporate social responsibility

- Honesty in business practice

- Bribery and corruption

- Reputation and risk

- Whistle-blowing

- Anti money-laundering

Example of Ethics CPD

| YEAR | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Total |

| 2 hours | 1 hour | 1 hour | 4 hours | ||||

| 1 hour | 1 hour | 2 hours | 4 hours | ||||

| 1 hour | 2 hours | 1 hour | 4 hours | ||||

| 2 hours | 1 hour | 1 hour | 4 hours |

CPD Deficiencies

If you have a deficiency in either the annual or three-year cycle minimum CPD requirements, you will be required to submit a declaration of non-compliance by the following April 30. This declaration includes your commitment to address the CPD deficiency within the current calendar year (Rule 323.21).

Members who submit a declaration of non-compliance with the minimum CPD requirements are noted as “Conditional” on the CPA Saskatchewan register (Rule 323.23).

Generally, the Registrar’s acceptance of a declaration of non-compliance will include the following 3 conditions:

- That the member completes CPD activities within the calendar year equal to the prior year CPD deficiency in addition to the minimum CPD requirements established in Bylaws 23.2, 23.3, and 23.4

- That the member reports these CPD activities within the member portal no later than December 31 of that calendar year (Rules 304.3, 310.1, 310.3-4, 323.21-23).

- That the member agrees to advise CPA Saskatchewan when the required number of hours are obtained by emailing monitoring@cpask.ca.

The member will continue to be noted as “Conditional” on the CPA Saskatchewan register until such time as all 3 conditions are met and the Registrar has advised that no further action is required (Rule 323.23).

Should you fail to comply with the conditions relating to your declaration of non-compliance by the deadline specified, you will be referred to the Registration Committee (Rule 310.5) and will be required to provide a formal CPD plan demonstrating how you will return to compliance with the minimum CPD requirements in a reasonable period of time. Upon review, the Registration Committee may choose to restrict or suspend your registration (Rule 331.1). All member restrictions and suspensions are published on our website and within our member newsletter (Rule 334.1). A notice may also be sent to your employer (Bylaw 34.4).

Resources

Technical competencies (based on the CPA Canada Competency Map – Click here):

Enabling competencies: